Lo que gestionamos por ti

Desde el registro hasta sus presentaciones trimestrales, lo tenemos cubierto.

Configuración del registro

Alta de autónomo (Modelo 036/037 + RETA – tu seguridad social mensual)

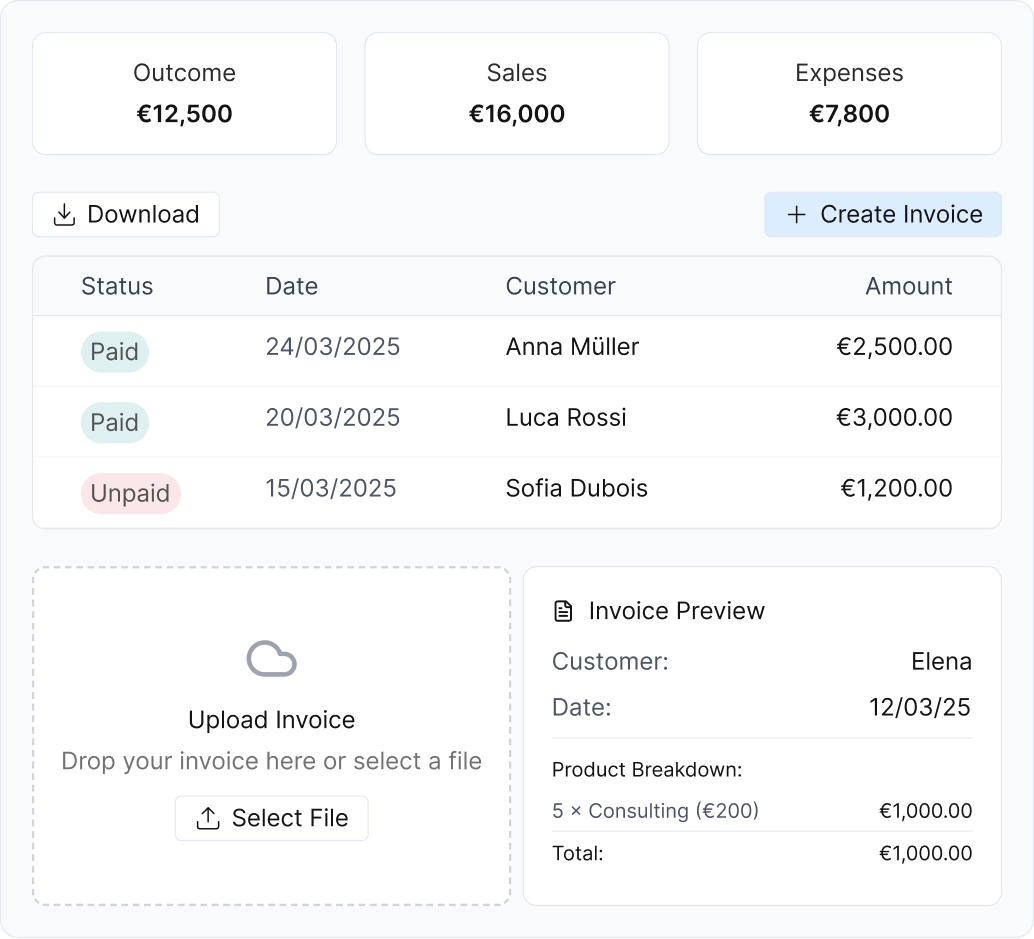

Gestión diaria

Contabilidad, herramientas de facturación y categorización de gastos: todo listo para la declaración de impuestos

Presentaciones regulares

Declaraciones de impuestos: Modelo 130 (IRPF) + Modelo 303 (IVA)

Presentación de fin de año

Declaraciones de fin de año: Modelo 100 (IRPF) + Modelo 390 (Resumen IVA)

Servicios especiales

Certificado digital, asesoramiento DTA (evitar la doble imposición), soporte multilingüe