Certified on Both Sides of the Atlantic

GDPR-Compliant Secure Filing

IRS Certified e-File Provider

AEAT Registered Tax Advisors

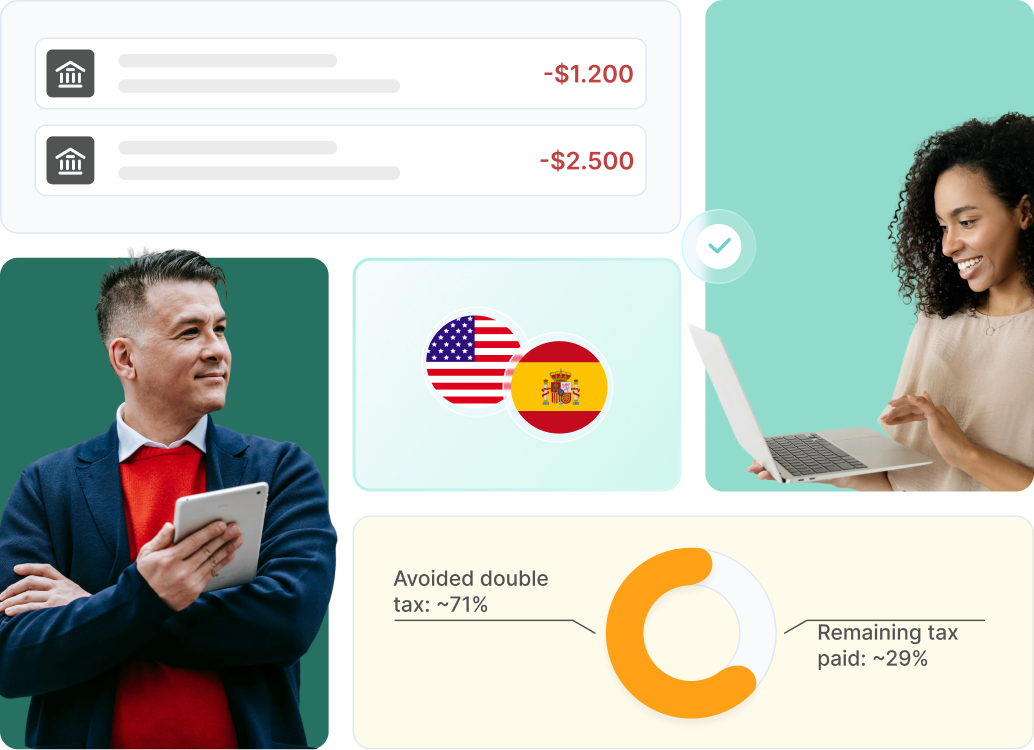

One bilingual tax team handles your US 1040 and Spanish IRPF, so you stay compliant and avoid double taxation.

Trusted by US expats across Madrid, Barcelona, Valencia, Málaga, and the rest of Spain.

GDPR-Compliant Secure Filing

IRS Certified e-File Provider

AEAT Registered Tax Advisors

Common problem

Answer

Do I still need to file US taxes even though I live in Spain?

Yes, the US taxes citizens on worldwide income. You must file Form 1040 every year, plus like FBAR or FATCA.

I already pay tax in Spain. Why do I still owe tax in the US?

If you don’t apply Foreign Tax Credit, FEIE, or US–Spain Tax Treaty correctly, you risk double taxation.

My US accountant doesn’t understand Spanish tax residency rules.

Many US CPAs lack knowledge of IRPF, Beckham Law, international residency, or Spanish income categories.

My Spanish gestor doesn’t understand US obligations like FBAR or FATCA.

Spanish accountants rarely know what Form 2555, Form 1116, or foreign reporting requirements mean.

I’m worried about IRS penalties because I’m overseas.

Expats risk fines for misfiling foreign accounts, foreign income, or not claiming the right credits.

We offer a coordinated tax solution for US citizens in Spain, covering IRS and AEAT requirements.

US Filing (IRS)

Form 1040

Foreign Earned Income Exclusion (2555)

Foreign Tax Credit (1116)

FBAR (FinCEN 114)

FATCA / Form 8938

US–Spain Tax Treaty application

State tax (if applicable)

Spain Filing (AEAT)

IRPF / Renta filing

Spanish residency determination

Declaring US-source income in Spain

Beckham Law eligibility assessment

Worldwide income planning

We understand both tax systems and how they interact — something single-country accountants cannot provide.

We correctly apply FEIE, FTC, and treaty rules to reduce or eliminate duplicate taxes.

Your 1040 and IRPF are reviewed together to prevent mismatches that could trigger audits.

We know your real-life issues: foreign accounts, multiple currencies, remote income, foreign rentals, pension income.

You upload documents. We handle the rest.

Tell us about your income, residency, and filing history.

Use our encrypted portal to submit everything safely.

IRS (Form 1040) + Spanish IRPF, reviewed together, filed on time.

If you have a US passport and live in Spain, this is for you.

Americans living permanently or temporarily in Spain

Remote employees earning US wages while based in Spain

Digital nomads planning to stay 6+ months

Dual citizens (US–Spain)

Americans with Spanish income (employment, freelance, rentals)

Retirees receiving US pensions while residing in Spain

Americans applying for the Spanish Digital Nomad Visa or Beckham Law

Choose the level of service that fits your needs

Stay compliant, avoid double taxation, and let bilingual experts handle everything.

Do I need to file US taxes while living in Spain?

Yes. All US citizens and green card holders must file a US tax return every year, regardless of where they live.

Will I get double taxed by the US and Spain?

Not if filed correctly. Using Foreign Tax Credit, FEIE, and the US–Spain Tax Treaty, we eliminate double taxation for most clients.

What about FBAR and FATCA filings?

If you hold over $10,000 across foreign accounts at any time, FBAR is mandatory. We handle FBAR + FATCA filings.

Can you file my Spanish tax return too?

Yes. We file your IRPF and coordinate values with your US return to ensure consistency.

Is my information secure?

Absolutely. We follow EU GDPR guidelines and IRS confidentiality standards.