Form 303

Content:

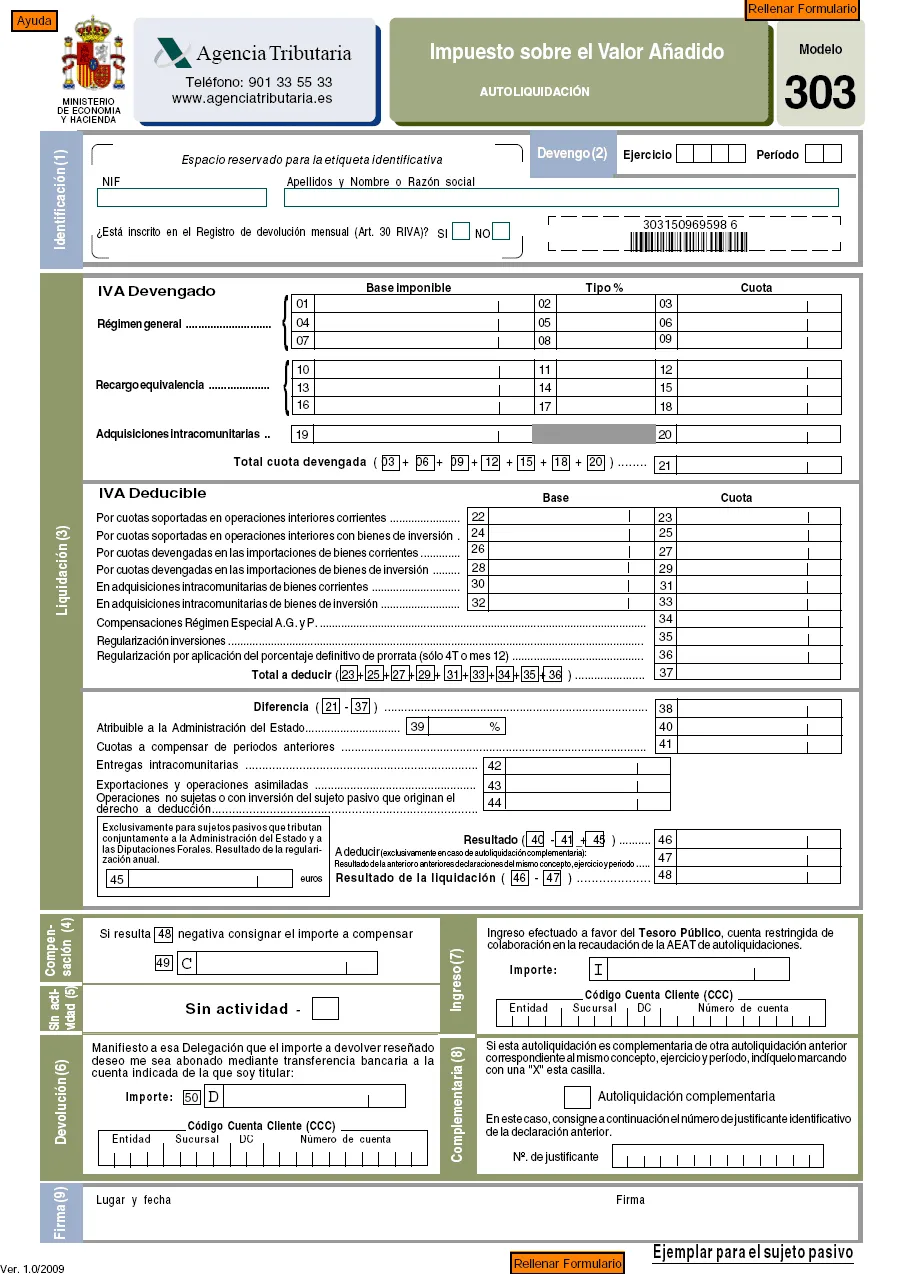

What is Form 303 and what is it used for?

Form 303 is the quarterly Value Added Tax (VAT) return. It consists of the VAT payment, for which you must pay the Treasury quarterly the difference between the VAT charged on your sales invoices and the VAT charged on your expense invoices.

This form must also be used to declare the bases for acquisitions or deliveries of intra-community goods or services, exports, transactions not subject to localization rules, one-stop shop transactions, and transactions subject to reverse charge.

Its annual equivalent is Form 390, which is a summary of all quarterly VAT forms filed during the year. For this reason, it's essential that you have all your quarterly forms filed correctly.

How do I file Form 303 for VAT with the AEAT?

In accordance with Order HFP/1395/2021 of December 9, the paper form will no longer be submitted as of January 1, 2023. Electronic submission requires an electronic DNI or Cl@ve PIN. Large companies, public limited companies, large taxpayers, and limited liability companies are required to use electronic signatures.

Deadlines for submitting VAT form 303

Form 303 is submitted within 20 days after the end of the 4 quarters and is divided as follows:

- Invoices from January to March: from April 1st to April 20th, both inclusive.

- Invoices from April to June: from July 1st to 20th, both inclusive.

- Invoices from July to September: from October 1st to 20th, both inclusive.

- Invoices from October to December: from January 1st to 30th, both inclusive.

Be careful! Even if you have no activity during a quarter, you must file this form . Remember to do so on time because any delay or error in Form 303 can lead to problems with the Treasury.

The only exception to the aforementioned filing deadlines is for self-employed individuals registered with REDEME , the Special Monthly VAT Refund Scheme. This is the only case in which Form 303 is filed monthly.

Who should submit Form 303 to the AEAT?

Any professional or business owner who carries out an activity subject to VAT is required to submit Form 303 to the Tax Agency every quarter.

This is regardless of the type of business (company, self-employed, association, cooperative, civil society, etc.) and the result of the declaration (to be paid, zero, refusal to offset or refund).

Landlords of real estate or property and real estate developers must also submit it.

The only exceptions to filing Form 303 are those activities exempt from VAT, such as medical, healthcare, psychological, or education and training services, among others.

Penalties for filing Form 303 late

Submitting Form 303 late may result in a penalty or a surcharge from the Tax Agency, depending on who notices the error.

If the Tax Agency sends you a notice, you risk a penalty. If, on the other hand, you notice it and file it before the AEAT fine arrives, the surcharges for filing Form 303 late will be as follows:

- 1% fixed plus an additional 1% for each month that is completed in the delay in filing the liquidation or declaration of the model.

- Once more than 12 months have passed since the end of the term, the surcharge will be 15% plus interest.

If you fail to pay your tax debt, the General Tax Law will classify the penalty: minor, corresponding to 50% of the amount owed, serious, 100%, and very serious, 150%.