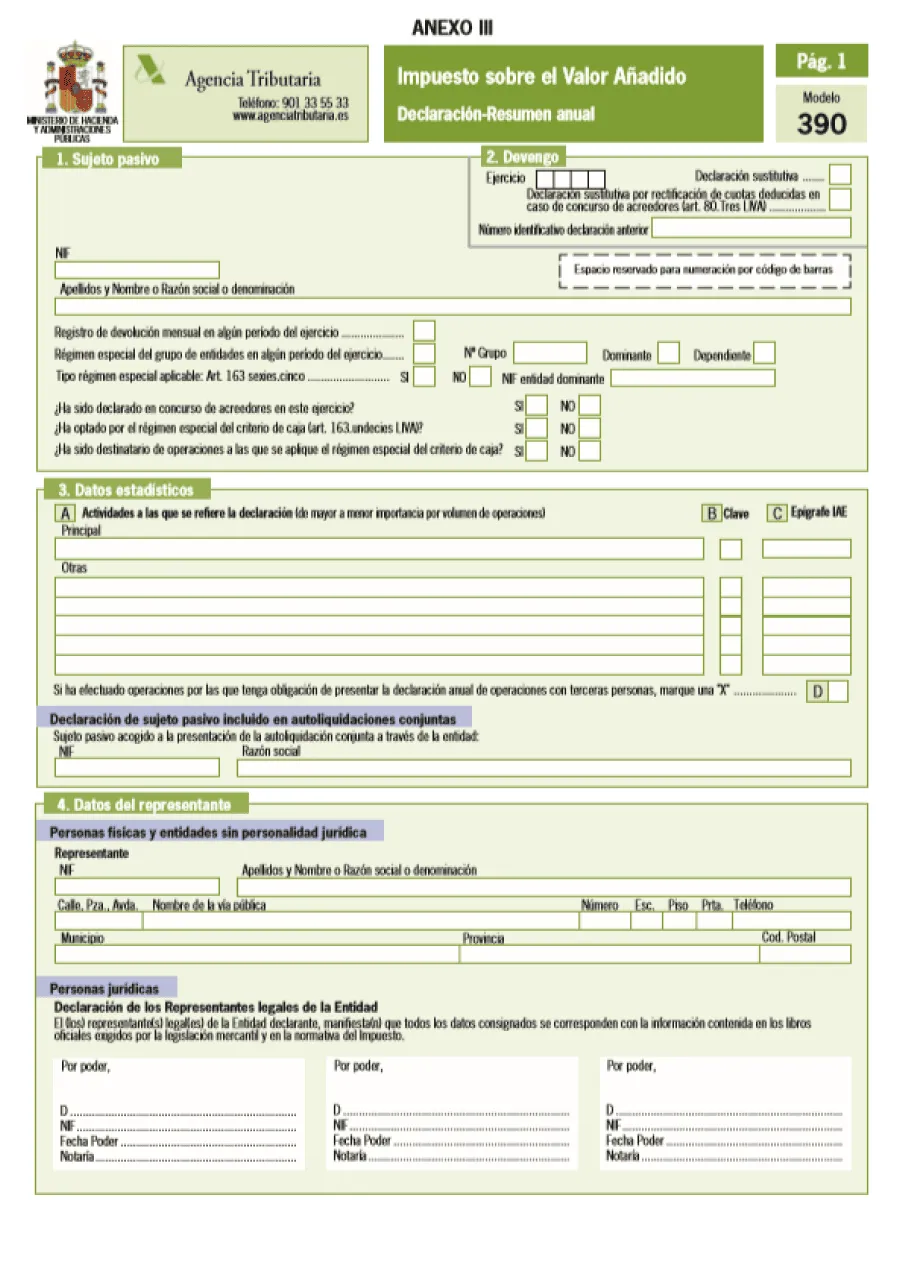

Model 390

Content:

What is the AEAT Form 390 and what is it used for?

Form 390 is an informative return that includes all transactions related to the settlement of Value Added Tax (VAT) during the fiscal year . It is a summary of the returns filed quarterly using Form 303, but in this case, on an annual basis.

This form, being purely informative, does not incur any fees, but it is mandatory for self-employed individuals and companies , who must demonstrate compliance with the quarterly forms. In other words, the compilation of Form 303 and the summary of Form 390 must match and align to avoid financial penalties from the Treasury.

Deadlines for filing Form 390

Form 390, being an informative return, must be submitted annually to the Tax Agency from January 1 to 30 of the year following the fiscal year to which the return corresponds.

For example, if you want to file your 2023 annual VAT return, you must file Form 390 in January 2024.

Instructions for completing form 390

VAT Form 390, like most forms, must be submitted online to the Treasury's Electronic Office using a digital certificate or PIN . You also have the option of submitting it in person at the Tax Agency's headquarters.

To complete your annual VAT summary, you'll need to know certain information. Correctly filing your quarterly Form 303 returns will make it easier to extract this information:

- The taxable base for income and expenses and the value of the VAT quota.

- The VAT tax rates applied: 0%, 4%, 5%, 10%, 21%.

- The total taxes included in the invoices and the total due.

On the other hand, be sure to define the source of your income or expenses to determine whether they are domestic, intra-EU, or extra-EU. It's also important to differentiate between current expenses and investment expenses , as well as verify that you've accounted for all deductible expenses applicable to your business.

Who should file Form 390?

There are some situations in which a legal entity will be required to formally file VAT Form 390.

Annual Form 390 must be filed by any self-employed person or company that carries out an activity subject to VAT and files the quarterly return using Form 303.

Even if no revenue is generated during the fiscal year, both forms are mandatory. However, there are some groups who are not required to file this tax form : self-employed individuals who pay taxes under the simplified tax regime and other self-employed individuals who rent urban real estate.

Exempt from filing form 390.

Self-employed individuals who pay taxes under the simplified tax regime , which we refer to as modules. That is, those who file taxes using this method. In this case, the Treasury does not require this group to submit personal income tax records for their activity.

Self-employed individuals whose activities involve leasing urban real estate, or whose activities involve leasing . That is, professionals who provide premises for a third party to carry out their activity will also be exempt.

Other groups that are not required to submit Form 390:

- Taxpayers who are required to file non-periodic self-assessments.

- Companies with an annual turnover of more than €6,010,121.04.

- Individuals or companies registered in the Monthly VAT Refund Registry (taxpayers included in the SII).

- Groups of companies for VAT purposes

Penalties for filing Form 390 late

Failure to file Form 390 or filing it late may result in certain penalties from the Treasury:

Late VAT filing without a request from the Treasury: These are the penalties the Tax Agency can apply if you missed the deadline but realized it before the tax authority asked you to pay.

- 1% fixed plus an additional 1% for each month that is completed in the delay in filing the liquidation or declaration of the model.

- Once more than 12 months have passed since the end of the term, the surcharge will be 15%.

Late VAT filing due to a request from the Treasury:

This isn't the most common situation, as it usually takes a long time for the Treasury to send a request, but if this were the case, we would find ourselves in the following scenario:

- The penalty for failure to pay this tax debt is imposed by the General Tax Law, which classifies violations as minor, serious, or very serious. The penalty is based on the amount not paid on time. For minor violations, the penalty will be 50% of the amount not paid; for serious violations, it will be 100%; and for very serious violations, it will be 150%.