Model 130

Content:

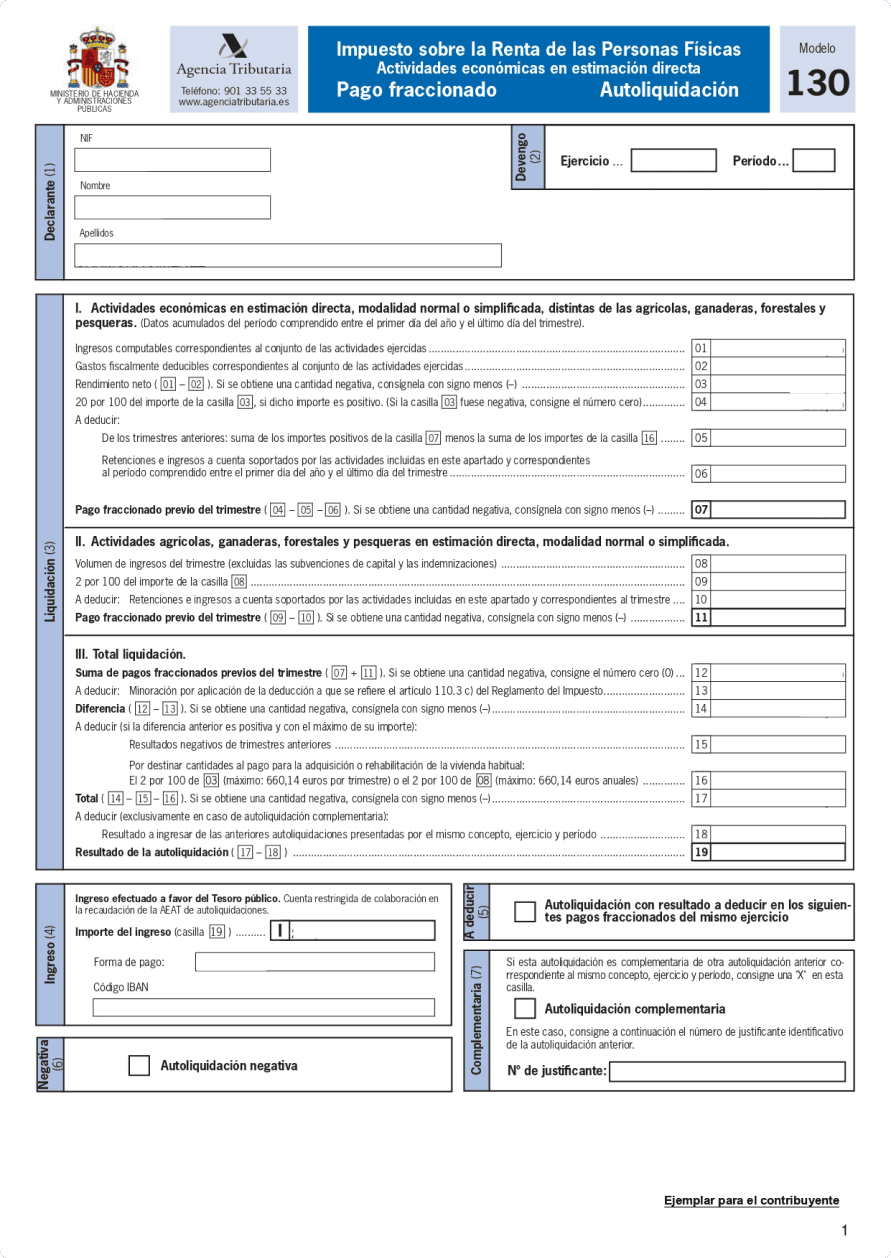

What is the AEAT form 130?

Form 130 is the self-assessment form for the partial payment of personal income tax that all individuals who carry out economic activities using a normal or simplified direct assessment must submit.

It is a quarterly income and expense statement for which self-employed workers pay 20% advances on their income tax return, just as employees do with the income tax withholding deducted from their paychecks.

The difference is that with Form 130, 20% of the activity's income is paid.

How to file Form 130 for Personal Income Tax.

Self-employed individuals can submit Form 130 in two ways: first, they can submit it in paper form using the template provided by the Tax Agency. This form can be filled out, printed, and submitted to the bank or the Tax Office.

On the other hand, there is a digital option, in which the filing is done electronically through the Tax Agency's portal. Digitalization is increasingly being used to manage these types of procedures; it also makes the task much easier for taxpayers.

Deadlines for self-employed workers to submit Form 130.

The submission of Form 130 for self-employed workers must be made within 20 days after the end of the quarter:

- 1st Quarter: from April 1st to 20th, both inclusive.

- 2nd Term: July 1st to 20th, both inclusive.

- 3rd Quarter: October 1st to 20th, both inclusive.

- 4th Quarter: January 1st to 20th, both inclusive.

Who should file Form 130?

They must submit form 130:

- Entrepreneurs registered in a business activity, provided they are not included in the module system, must submit Form 131.

- Self-employed individuals who carry out professional activities, provided they have not applied withholding taxes on more than 70% of their turnover to companies, self-employed individuals, and legal entities based in Spain.

- Those who participate in a community of property in terms of the income that corresponds to them based on the percentage of participation in the organization.

Penalties of model 130

Form 130 must be filed within the established deadlines to avoid fines from the Treasury, although if you are the one who realizes the error, you could be exposed to these penalties:

- For each month that the filing of the liquidation or declaration of the model is delayed: 1% fixed plus another 1% additional per month.

- Once 12 months have passed since the deadline for submitting the form: 15% plus interest.

If, on the other hand, the Tax Agency sends you a notice for not filing your tax return on time, the penalty could be 40% of your lost income; a serious penalty of 100%; or a very serious penalty of 150%.

This penalty is subject to a 40% discount, and an additional 30% discount on this amount, provided no appeal or claim is filed against the regularization of the fee or interest.