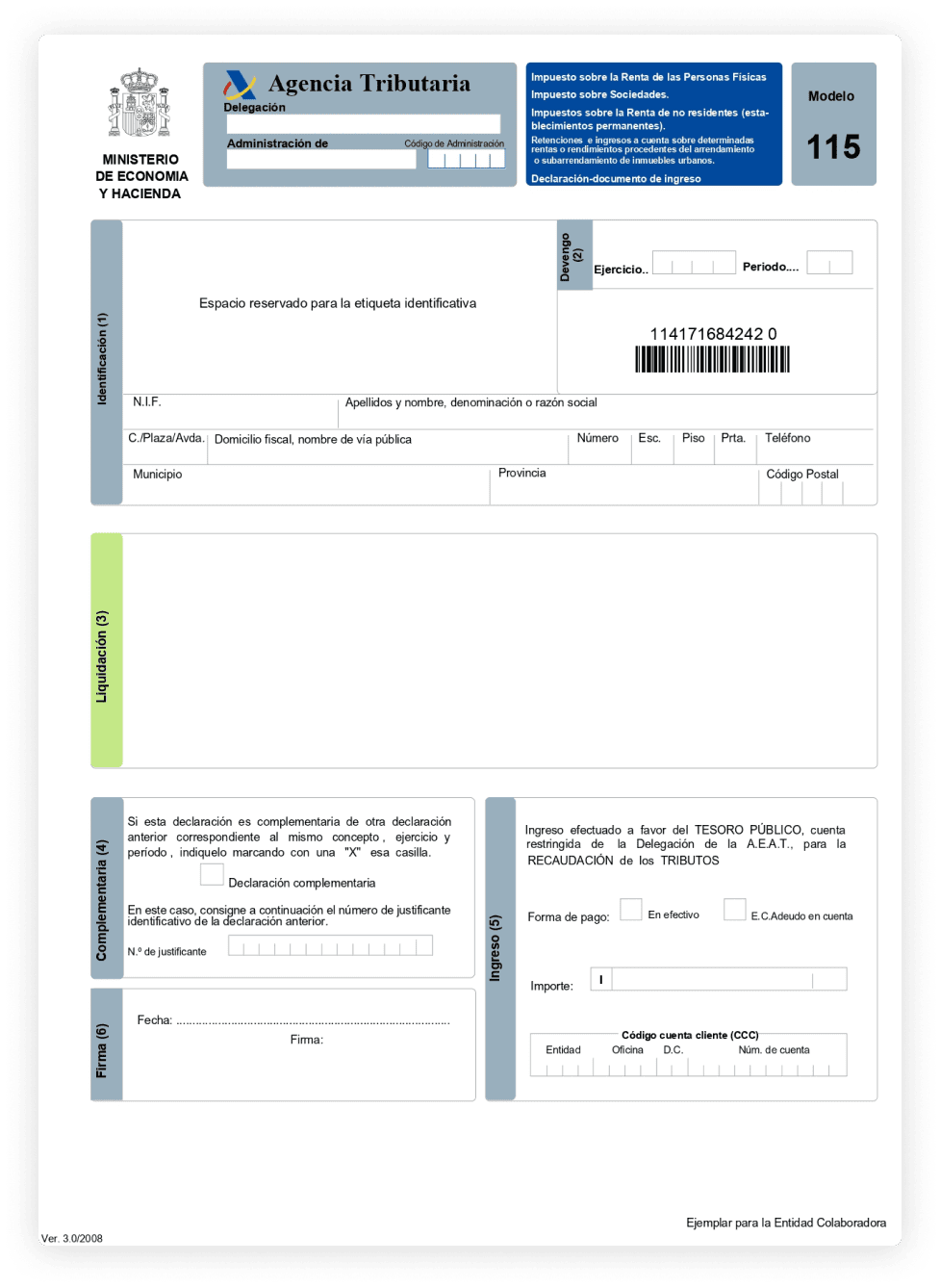

Model 115

Content:

What is Form 115 and what is it for?

In its strictest definition, Form 115 is a self-assessment used to declare withholdings from rental income. In other words, all self-employed individuals or companies that rent premises for their business are required to file it.

This model is colloquially known as the “rental model.”

Deadlines for submitting Form 115

Form 115 is submitted within 20 days after the end of the quarter:

- 1st Quarter: from April 1st to 20th, both inclusive.

- 2nd Term: July 1st to 20th, both inclusive.

- 3rd Quarter: October 1st to 20th, both inclusive.

- 4th Quarter: January 1st to 20th, both inclusive.

The rental withholding tax form can be submitted on paper or electronically. We recommend doing so to save time.

Who should submit Form 115 AEAT?

All companies or self-employed individuals who pay rent for premises or offices for the purpose of conducting their business must submit Form 115.

If the landlord of the office or premises is an individual and the rental invoice does not specify the IRPF withholding, we must still withhold and submit Form 115. In this case, you must also withhold and submit Form 115.

Another example is the rental of parking spaces. For this type of rental, we must also include this in the model.

- If the landlord is exclusively dedicated to renting properties and provides us with an exemption certificate from the Tax Agency because it is included in activity heading 861 of the IAE (Equity Tax). These are Listed Real Estate Investment Companies.

- Rental of rustic plots

- The rent does not exceed 900 euros per year with the same landlord.

- Financial leases

To file Form 115, you must collect all invoices from which you have withheld personal income tax for rentals.

Penalties for filing Form 115 late

Submitting Form 115 late may result in a notice of action or a penalty from the Treasury.

If you realize the error without receiving a notification from the Tax Agency, file Form 115 as soon as possible. This way, you'll only be charged the following surcharges:

- 1% fixed plus an additional 1% for each month that is completed in the delay in filing the liquidation or declaration of the model.

- Once more than 12 months have passed since the end of the term, the surcharge will be 15% plus interest.

If, on the other hand, it is the Tax Agency that sends you a request, you face the following penalties:

- Minor infraction: penalty of 50% more than what you have not paid to the Treasury.

- Serious violation: penalty of 100% more than what you have not paid to the Treasury.

- Very serious violation: penalty of 150% more than what you have not paid to the Treasury.

If there are no resources to try to remove the penalty, there is a 40% discount and, on top of that, an additional 30%.