Model 111

Content:

What is Form 111 AEAT and what is it used for?

Form 111 is the return used by companies and self-employed individuals to declare and pay the personal income tax withholdings they have made during the quarter for employees, professionals, or business owners. Unless the personal income tax withheld is zero, this return must be submitted to the Tax Agency.

Let's take an example: if you have employees, their payroll will have an income tax withholding. This amount is deducted from the employee's paycheck, and you, as the employer, must pay it. Later, this employee will file their personal income tax return using Form 111. The same applies to invoices you receive from professionals as in the previous case.

In short, it's a "deposit" that the Treasury can later return to the employee or employer, depending on the case, through the personal income tax return.

How do you submit Form 111?

Form 111 can be submitted to the Treasury either online or in person. If you are a company, you can only submit this form online.

To submit this model, the following instructions must be followed:

- Access the Treasury website through this link (Form 111: Withholdings and payments on account).

- Click "Submission" and choose between a digital certificate or cl@ve PIN (if you prefer to submit a paper copy, click "Pre-declaration." Choose between a certificate and Form 111 form for submission).

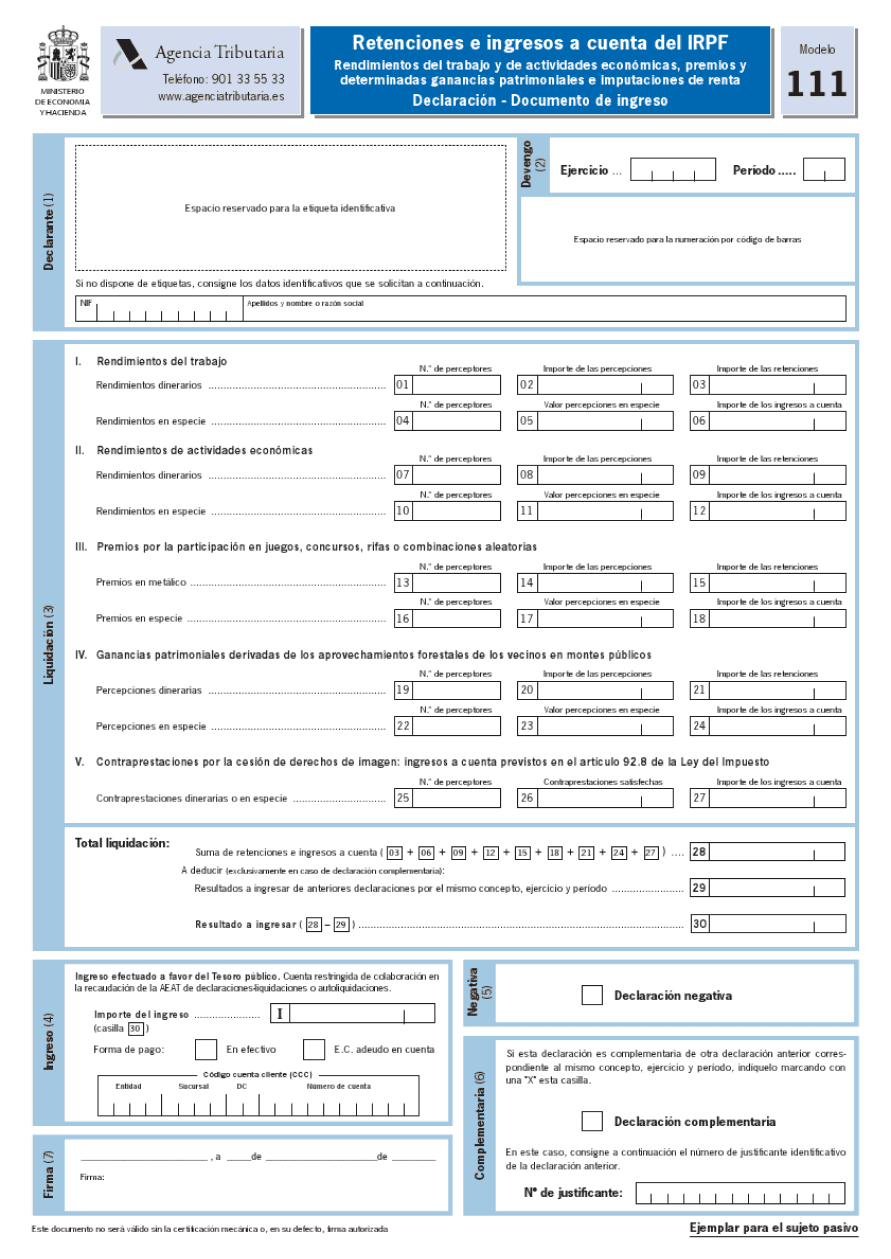

- Complete the "Identification" section, which identifies the taxpayer; the "Accrual" section, to specify the current year and quarter in question; and the "Settlement" section, to record information on employment income and economic activities to which the withholding has been applied.

- Indicate the number of recipients, the amount of withholdings, the amount of payments on account and payments in kind.

- Once you've completed all the requested information, you must add the withholdings and payments made under the previous headings. This will take you to box 30, where the final result of Form 111 will include the amount you must pay to the Treasury.

If no withholdings have been made, the self-assessment will be negative.

Deadlines for submitting Form 111 and how to do it.

Form 111 must be filed within 20 days of the end of the quarter. For large companies, it can be filed monthly:

- 1st Quarter: from April 1st to 20th, both inclusive.

- 2nd Term: July 1st to 20th, both inclusive.

- 3rd Quarter: October 1st to 20th, both inclusive.

- 4th Quarter: January 1st to 20th, both inclusive.

For large companies, Form 111 can be filed monthly, during the first 20 calendar days of the month following the corresponding monthly self-assessment period.

Who should submit Form 111?

Self-employed workers and companies that have applied withholdings in the following areas must submit Form 111 AEAT:

- Employment income: employee salaries or severance pay

- Income from economic activities: professional, agricultural, livestock and forestry, or business activities in objective estimation (declared by modules).

- Income from intellectual and industrial property , image rights, etc.

- Prizes for participating in games, raffles, or contests

- Capital gains from forestry exploitation in public forests

In addition, the following should be taken into account:

Form 111 is not required if invoices received from professionals with no income tax withheld. This form is required if you have employees with zero income tax.

Penalties for filing Form 111 late

If you're self-employed and file Form 111 late, the Treasury may fine you. These fines may vary depending on how much time has passed since the deadline for filing the corresponding form.

They can be of the type:

- Fixed fine of 100 euros for each calendar quarter of delay (minimum 150 euros and maximum 1,500 euros).

- A fine of 1% of the amount of withholdings and payments on account that should have been declared on Form 111 (minimum 150 euros and maximum 6,000 euros).

- A 1.5% fine will apply to the amount of withholdings and payments on account that should have been declared on Form 111 if the filing is made outside the established deadline and without prior notice from the Administration.