Form 349

Content:

What is Form 349 AEAT and what is it used for?

Form 349 is a monthly or quarterly information declaration in which self-employed individuals and companies detail all their intra-Community transactions , i.e., sales of goods or services to companies or professionals located in other European Union Member States. Keep in mind the following key points about Form 349:

- It is mandatory to submit it if you are self-employed or have a company and carry out intra-community transactions , regardless of the VAT regime under which you pay taxes.

- You should only include transactions you carry out with companies or professionals ; that is, if you sell or buy from individuals, it is not considered an intra-community transaction.

- This model only applies to professionals who conduct business with countries belonging to the European Union . If they no longer belong to the EU, the country would be excluded.

Remember that if you want to operate with clients or suppliers in the European Union , you must register with the Registry of Intra-Community Transactions using Form 036 .

As a new development in the face of the new normal brought on by COVID-19, we can highlight that the Tax Agency requires that Form 349 include transfers of goods shipped or transported from the territory where the tax is applied to another Member State.

The exemption for transfers of reserve stock under consignment sales agreements has also been simplified.

To simplify the transaction, deliveries of goods made through consignment sales will result in a single transaction.

When is Form 349 filed?

Generally speaking, Form 349 AEAT is filed during the first 20 calendar days of each month.

Except for the month of July , which may be submitted during the month of August and the first 20 calendar days of September, and the one corresponding to the month of December , which must be submitted during the first 30 calendar days of January.

Keep in mind that intra-community sales (excluding purchases) must be taken into account when calculating the frequency . If you only make purchases, you can choose the frequency you prefer.

Deadlines for submitting Form 349

Quarterly : If the total amount of goods and services delivered (excluding VAT) does not exceed €50,000 during the reference quarter or in each of the four preceding calendar quarters. The filing deadlines are as follows:

- 1st Quarter: April 1-20.

- 2nd Quarter: July 1-20.

- 3rd Quarter: October 1-20.

- 4th Quarter: January 1st to 30th.

Annual : Form 349 must be filed annually if the value of goods or services provided during the previous year does not exceed €35,000 (excluding VAT). Furthermore, the total value of goods delivered to another Member State must not exceed €15,000 . The filing period is from January 1 to 30.

If you don't carry out any intra-Community transactions for any year, you don't need to file Form 349. The only thing to keep in mind is that the Tax Agency will remove you from the Register of Intra-Community Operators.

Who should submit Form 349?

All VAT taxpayers who have carried out intra-Community transactions are required to notify the Treasury by submitting Form 349.

For this to happen, the following conditions must be met:

- The transaction must not be carried out within the territory where the tax applies. That is, the sale must be made from one of the 28 EU countries to another EU country, but with a different tax rate.

- It is important to note that transactions with the Canary Islands, Ceuta, and Melilla are not considered intra-Community transactions, but rather imports or exports.

- The seller and buyer of the transaction must be self-employed or a company.

- Both must be officially registered as intra-community operators and have an intra-community VAT number.

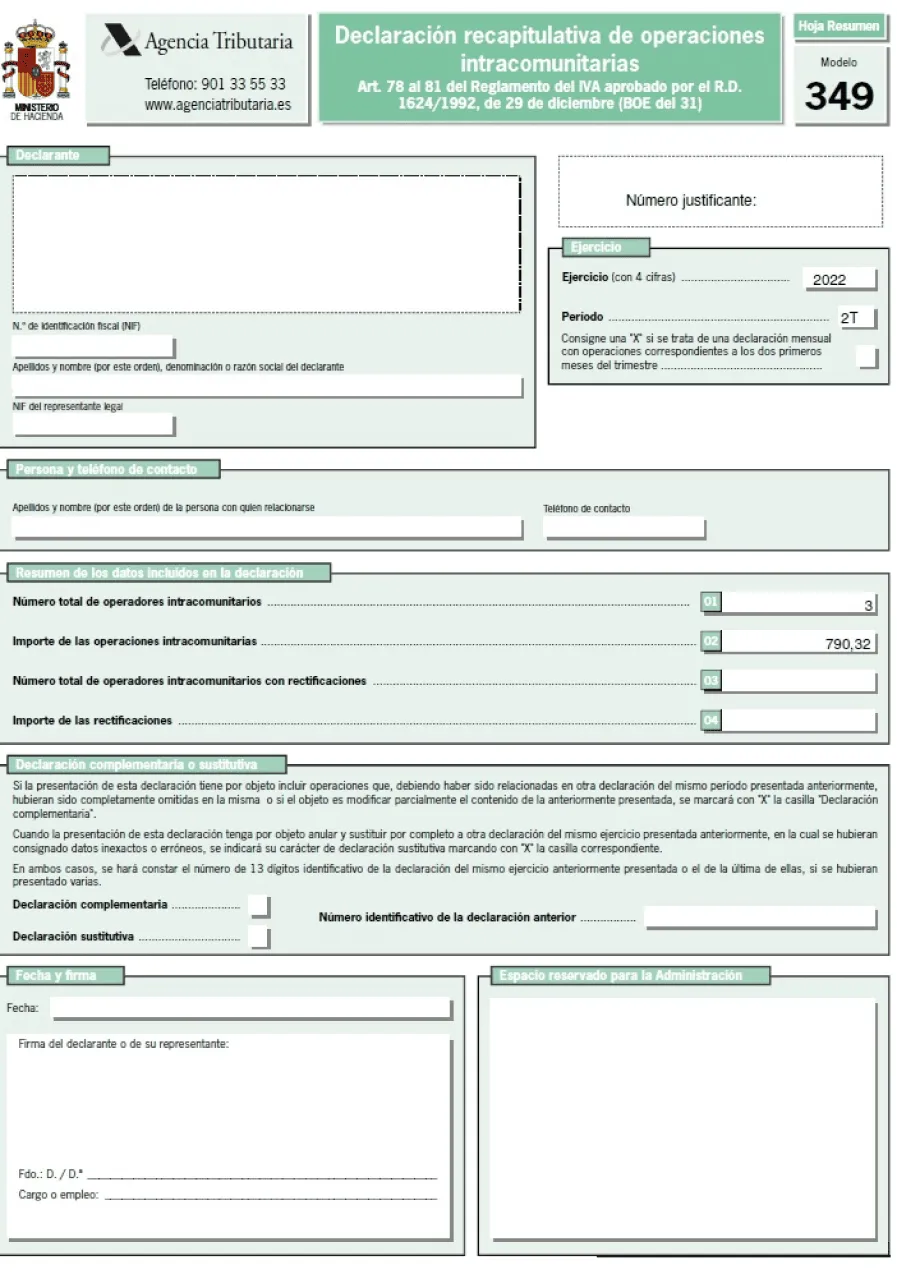

How to submit Form 349 to the AEAT?

You can submit it online or through your advisor. Below, we show you the steps to submit Form 349 correctly:

- Access the Form 349 section, Information Declaration and Summary Declaration of Intra-Community Transactions, on the AEAT Electronic Office.

- Go to the Procedures section and click on Submissions (via file); then go to Submission . You will be asked for your digital certificate or PIN code.

- Import your file and you'll be redirected to a screen with a summary of the automatically filled-in information. Click Sign and Send if the information is correct. You're done!

As a final update regarding deliveries of goods, you should take into account :

- Key R , referring to transfers of goods made within the framework of consignment sales agreements.

- Key D , on returns of goods from another Member State to which they were previously sent from the TAI within the framework of agreements for the sale of goods.

- Key C , for substitutions of the entrepreneur or professional recipient of the goods sent or transported to another Member State.

Important note: Include the information from Form 349 in Form 303 of your VAT return. The information must match.

Penalties for filing Form 349 late

Filing Form 349 late may result in a penalty of a fixed amount of 20 euros for each omitted item of data or set of data. The minimum penalty is 300 euros and the maximum is 20,000 euros.

Since this is an informative model, which does not cause economic damage to the Treasury , the penalties could be reduced by half if it is submitted late without prior request from the AEAT.