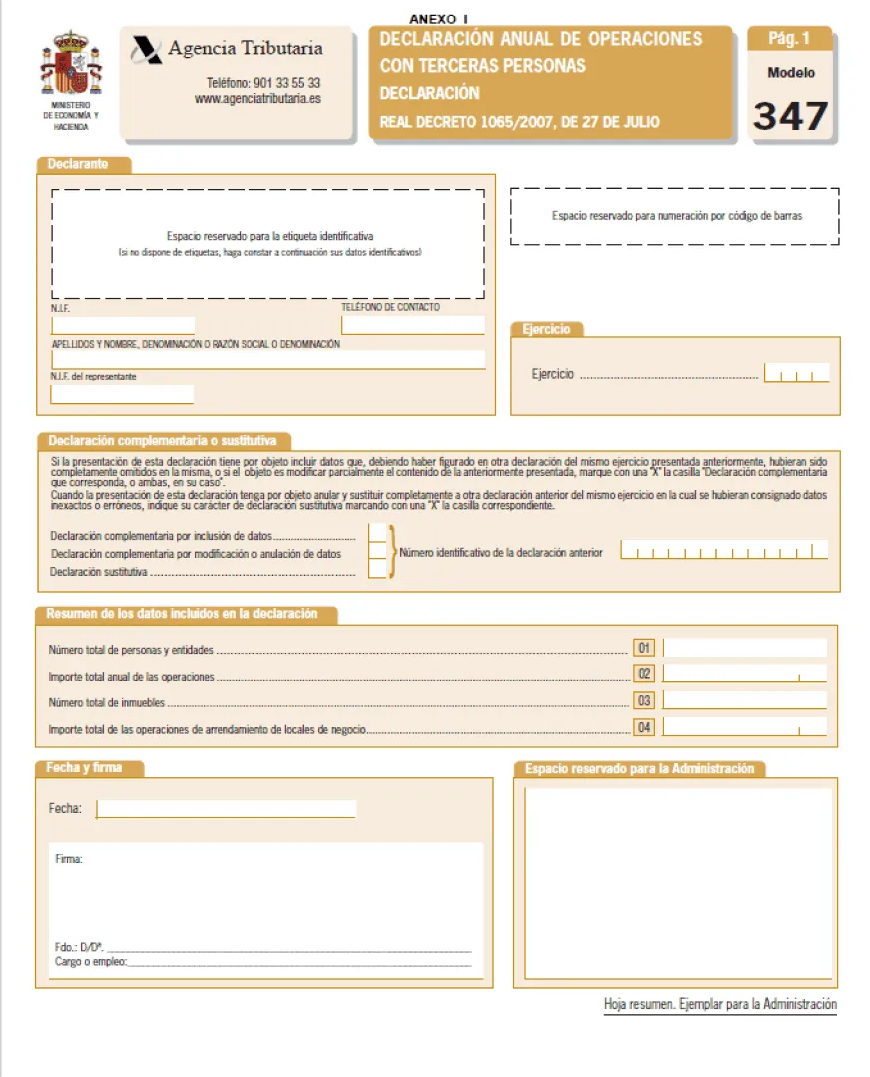

Form 347

Content:

What is the AEAT form 347?

Form 347 of the Tax Agency (AEAT) is an annual information declaration that includes all transactions carried out with third parties, whether clients and/or suppliers, provided that the total amount of transactions exceeds €3,005.06 (VAT included) during the previous fiscal year.

Please note that, as this is merely an informative submission, the declaration of this form does not entail any payment or refund.

Deadlines for submitting Form 347

This form must be submitted annually during the month of February, with the deadline being the last day of that month. The return refers to the immediately preceding fiscal year, taking into account transactions carried out during this period.

There is a period of four calendar days to submit the application outside the regulatory deadline , if due to technical problems, the submission could not be made via the Internet within the established dates.

Who is required to submit Form 347?

Natural or legal persons, public or private, as well as the entities referred to in article 35.4 of said law, that carry out business or professional activities , must submit an annual declaration regarding their operations with third parties:

- Self-employed persons and companies: any natural or legal person, public or private, who, in the course of their business or professional activities, invoices, regardless of the nature of their invoicing, an amount exceeding €3,005.06 per year.

- Social entities and homeowners' associations: They must also submit Form 347 for purchases of goods and services outside their activity that exceed the established amount. This does not include electricity, fuel, water supplies, and insurance.

Who is exempt from filing Form 347?

Those who carry out business or professional activities in Spanish territory but do not establish their headquarters in Spain and, in the case of entities under the income attribution regime established abroad, without having a presence in Spanish territory.

Individuals and entities in the attribution of income in personal income tax (for activities that are taxed in personal income tax based on objective estimation) and in VAT for the special simplified regimes or for fishing, livestock, and agriculture.

Taxpayers who have not exceeded €3,005 during the current calendar year or €300.51 during the same period when collecting payments on behalf of third parties.

Taxpayers who have exclusively carried out operations not subject to the obligation to declare , based on article 33.

All those who are required to report on transactions included in the VAT registration books through the AEAT electronic office (except those required by application of Article 36 of Royal Decree 1065/2007, of July 27).

How to submit form 347.

This form must be filed electronically through the Tax Agency. It can be done either using the Electronic Certificate, in the case of large companies, or using Cl@ve PIN, in the case of individuals who are not required to use an electronic signature or electronic certificate.

Penalties for filing Form 347 late

Filing Form 347 late may result in a penalty of a fixed amount of 20 euros for each omitted item of data or set of data. The minimum penalty is 300 euros and the maximum is 20,000 euros.

Since this is an informative model, which does not cause economic damage to the Treasury, the penalties could be reduced by half if submitted late without prior notice from the AEAT.