Form 145

Content:

What is Personal Income Tax Form 145?

Form 145 is a declaration in which family and personal information is provided to the payer so that the payer can then calculate the personal income tax withholding from the payroll. It is important to fill out this form correctly, as the company will calculate the withholdings based on the data shown.

Form 145 is one of the most important forms for your income tax return. The AEAT compares your income tax return with the withholdings you've previously paid throughout the year. It's important to note that if you've withheld more than you should, you'll be refunded the difference, but if you've withheld less, you'll have to pay using this form.

The most common way to fill out Form 145 is when starting work at a new company, or when there is a change in your personal or family situation.

Deadlines for filing Form 145

Form 145 must be completed and submitted to the payer on the first day of the year. With the change in fiscal year, the company must update each employee's data to calculate the personal income tax withholdings applied to their payroll. This is the time to do so if necessary.

Who should submit Form 145

Form 145 must be filed whenever there has been a change throughout the year, resulting in a higher withholding rate. The payer must be notified within 10 days of the change occurring.

If there are less than 5 days left to prepare the monthly payroll, the new withholding will be applied starting the month following the notification.

If you are self-employed, you should know that you may be required to file Form 145 in certain situations, such as when applying for benefits for cessation of activity, or other circumstances.

How to fill out Form 145

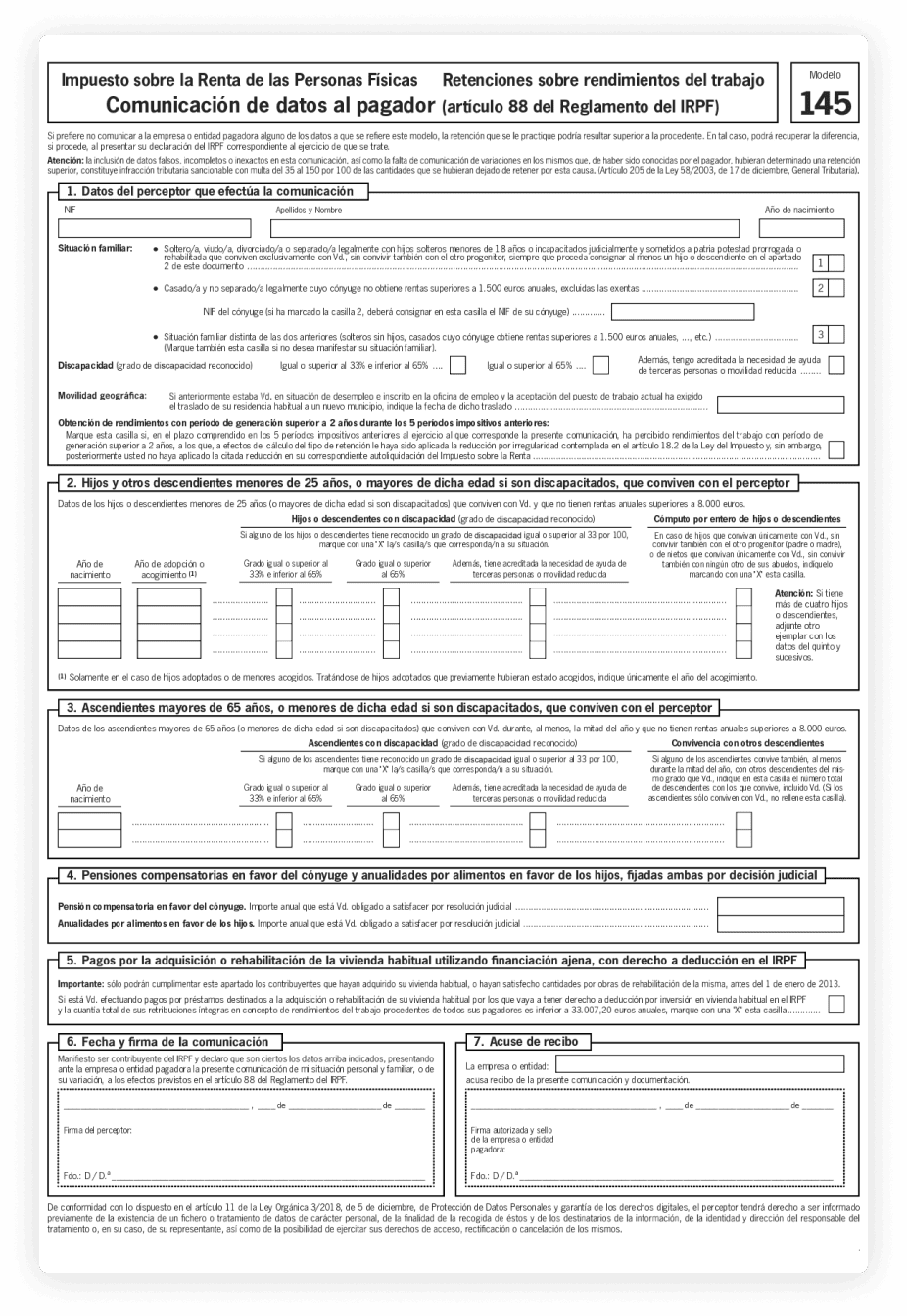

Form 145 consists of six sections to fill out and complete according to your personal and family circumstances. Let's detail them one by one:

- Identification and family status:

- In this section, you must verify and check your personal information: first name, last name, ID number, date of birth.

- Family status: Check the option that applies to you based on your current status.

- Disability: Check the box if you have a disability level greater than 33% and less than 65%, equal to or greater than 65%, or if you need assistance from others or have reduced mobility.

- Geographic mobility: Check this box if you were previously unemployed, found work, and had to move your usual residence.

- Earnings with a generation period of more than two years during the previous five tax periods: check if applicable.

- 2 Identification and family situation:

- Check and complete this section if you have children or other descendants (for example, grandchildren) under the age of 25 or disabled persons of any age who live with you and do not have an income exceeding €8,000 per year.

- Check the “Complete computation of children or descendants” box if the children live only with you and there is no shared custody (single-parent families).

- Ancestors

- In this case, we include ancestors over 65 years of age who are dependent on you and whose annual income does not exceed 8,000 euros. Important: Any ancestors with a disability who live with you must also be listed here, even if they are under 65.

- Alimony and food annuities

- If you have to pay child support or spousal support, you must indicate this in this section (if determined by a court decision).

- Deduction for external financing for the habitual residence

- Check this box if you are making any type of payment for the purchase or renovation of your primary residence through a mortgage. Important: You only need to fill this out if you purchased the home before 2013 and if you earn no more than €33,007.20.

- Signature, date and acknowledgment of receipt

- In this section, the signatures of both the company and the employee must be included. An acknowledgment of receipt is added because the company is responsible for withholding, and it is important to reflect that you have provided Form 145 so that they can process it according to the information contained therein.

Sanctions on form 145

Reporting false, incomplete, or inaccurate information that determines the withholding tax is considered a tax violation, as is failure to do so. There are two types of violations related to this model:

- Variation with a lower withholding rate

If the information reported to the payer is false, inaccurate, or incomplete, resulting in less withholding than required, a tax violation will be committed. This offense may be penalized with a fine of 35 to 150 percent of the amounts not withheld as a result.

For any changes that occur during the year and that result in a lower withholding rate, the employee may report them so that they can be adjusted.

- Variation with a higher withholding rate

If, on the other hand, changes in personal and family circumstances result in a higher withholding rate, the employee must notify the employee so that this withholding can be adjusted. This must be done within ten days of the change. This will be taken into account in the next payroll, provided there are at least five days remaining from the date of notification.

If, on the other hand, changes in personal and family circumstances result in a higher withholding rate, the employee must notify the employee so that this withholding can be adjusted. This must be done within ten days of the change. This will be taken into account in the next payroll, provided there are at least five days remaining from the date of notification.