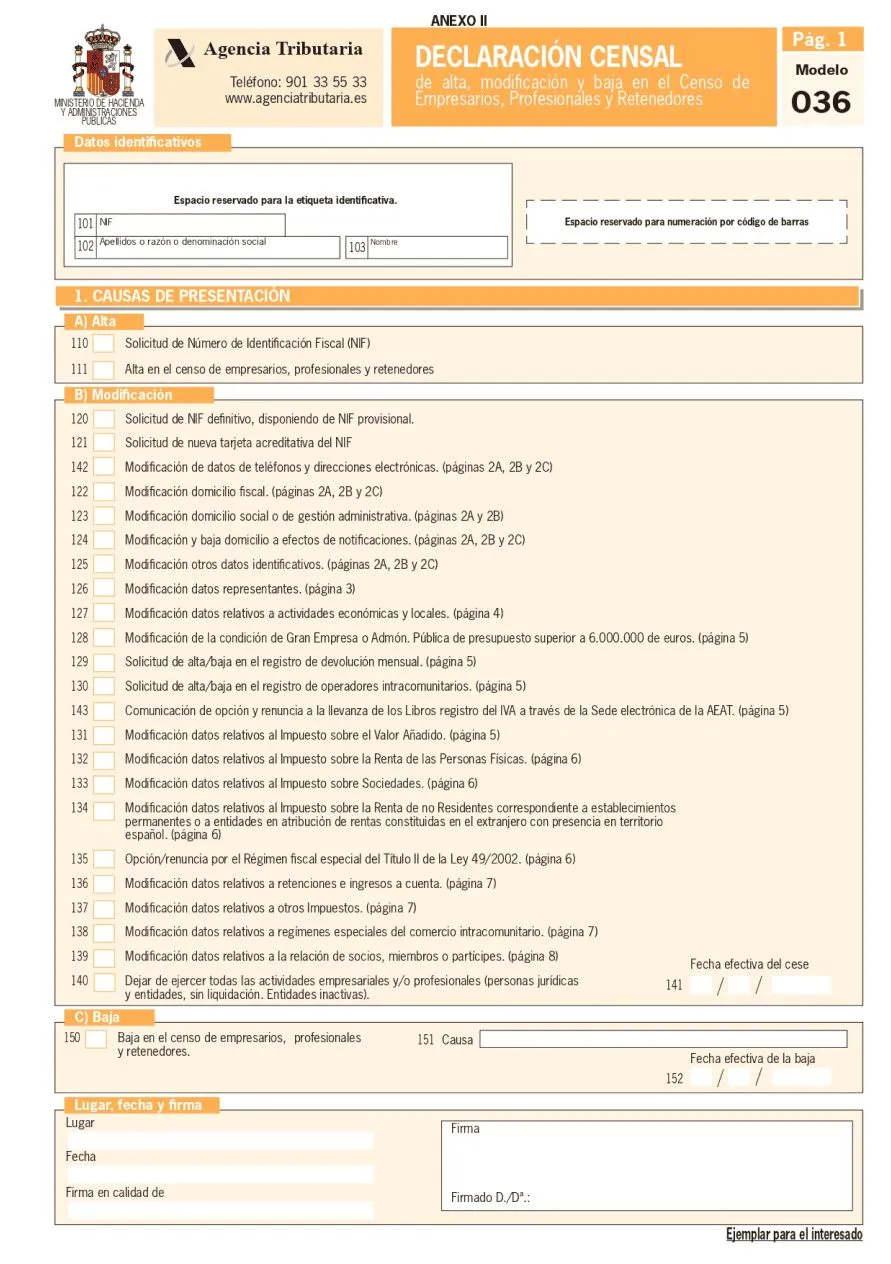

Form 036

Content:

Form 036 is the document you use to register with the State Tax Administration Agency ( AEAT ) in the Census of Business Owners, Professionals, and Withholding Taxpayers . This procedure is mandatory for starting a professional or business activity in Spain, both for self-employed individuals and corporations.

Essentially, Form 036 is the tool used to report your business's census information to the AEAT, from its incorporation to any relevant modifications. It's also essential for requesting the assignment of a definitive NIF (Tax Identification Number ).

Who should file Form 036?

Form 036 must be filed by all individuals or legal entities wishing to conduct economic activity in Spain. This includes:

- Self-employed workers , who must officially start their activity.

- Commercial companies , such as Limited Companies ( SL ), Public Limited Companies ( SA ) or other legal forms.

- Entities without legal personality , such as communities of property or unexpired inheritances.

Note: Self-employed individuals can opt for Form 037, a simplified version of Form 036, provided they meet certain specific requirements. The differences will be detailed later.

When should Form 036 be filed?

Form 036 must be submitted in the following situations:

- Registration in the census : Before starting any economic activity.

- Modification of census data :

- Changes in identifying data, such as tax address .

- Incorporation or modification of IAE headings .

- Changes in the VAT regime or other previously declared tax obligations.

- Deregistration from the census : When economic or business activity ceases.

- Assignment of the definitive NIF : For companies that have initially obtained a provisional NIF after their registration in the Commercial Registry.

Deadlines and retroactive nature

- Changes to census data must be notified to the AEAT within one month of the change.

- It is possible to file Form 036 retroactively, although this could result in penalties if the established deadlines are not met.

Recent developments in Model 036

Since 2023, several updates have been incorporated into Model 036, including:

- Digitalization of the procedure : Form 036 should preferably be submitted electronically through the AEAT's Electronic Office . This is mandatory for companies and legal entities.

- New boxes and simplification : New boxes have been added to specify the type of activity and the type of service provided, making it easier to comply with tax obligations.

- Review of the registration of IAE headings : Criteria for declaring economic activities under various headings have been unified, eliminating duplications.

- Electronic notifications : It is mandatory for companies and advisable for self-employed individuals to have an electronic notification system through DEHú .

Differences between Form 036 and Form 037

Form 037 is a simplified version of Form 036, designed for self-employed individuals with basic tax requirements. You can use Form 037 if you meet the following criteria:

- You are a natural person (self-employed).

- You are not registered under the simplified VAT regime or the equivalence surcharge regime.

- You do not act as an IRPF withholding agent, except for employees.

How to fill out and submit Form 036

Form 036 can be a complex process, especially for those inexperienced in tax matters. Therefore, it's advisable to seek the assistance of an expert to ensure that all tax obligations are properly met.

You can find detailed instructions and professional assistance on the official AEAT website or through our specialized services. If you need more information on how to process Form 036 or adapt to the new regulations, please do not hesitate to contact us.